Key Takeaways

- YZi Labs has invested in Avalon Labs, which focuses on Bitcoin-backed financial services.

- Avalon Labs aims to become the first fully regulated on-chain Bitcoin financial institution.

Share this article

YZi Labs, the venture arm previously known as Binance Labs, announced Monday that it has invested in Avalon Labs, an on-chain capital markets platform specializing in Bitcoin-backed financial products. The terms of the deal were not disclosed.

— YZi Labs (@yzilabs) May 26, 2025

Avalon Labs runs a CeDeFi lending platform that includes Bitcoin-backed lending, stablecoins, yield-generating savings accounts, and a credit card. The project enables Bitcoin holders to access instant liquidity without selling their assets by using Bitcoin-backed stablecoins such as USDa, the firm’s flagship product.

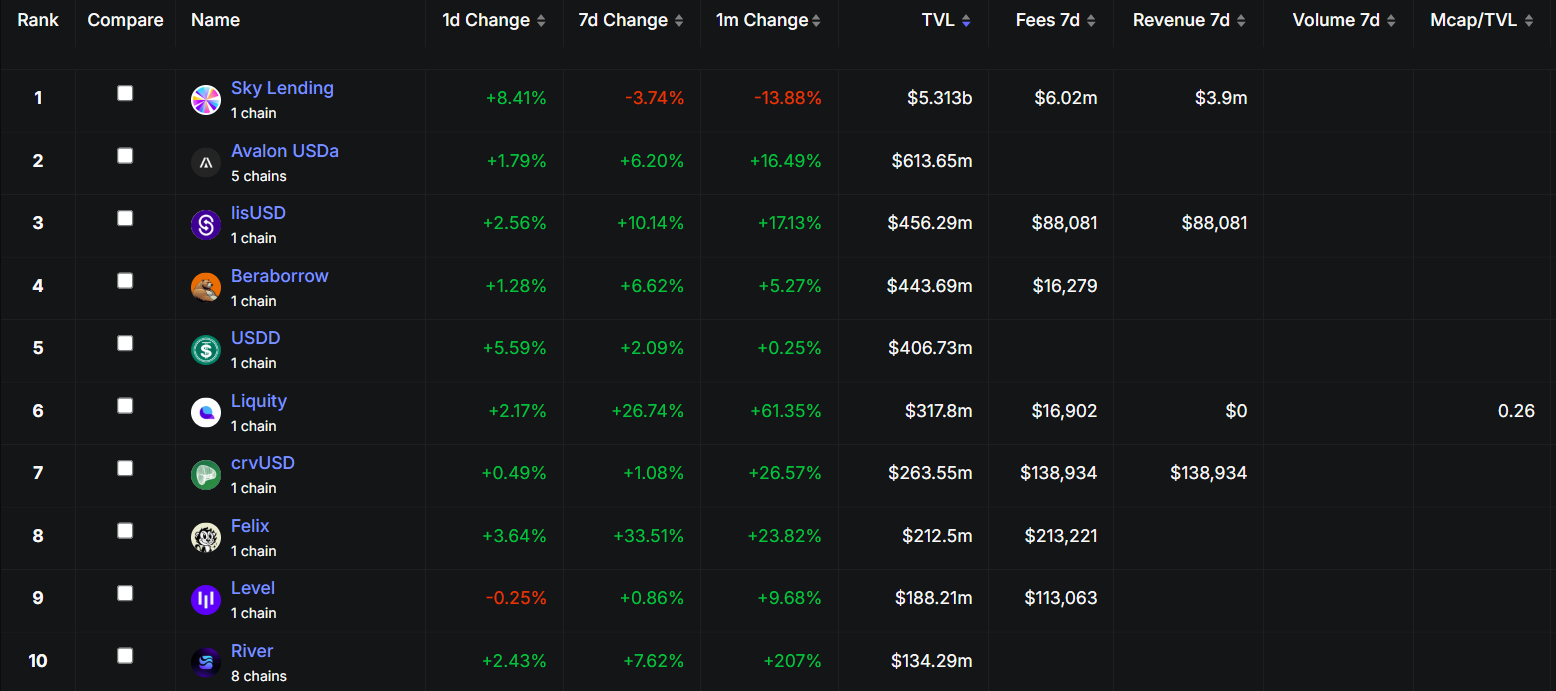

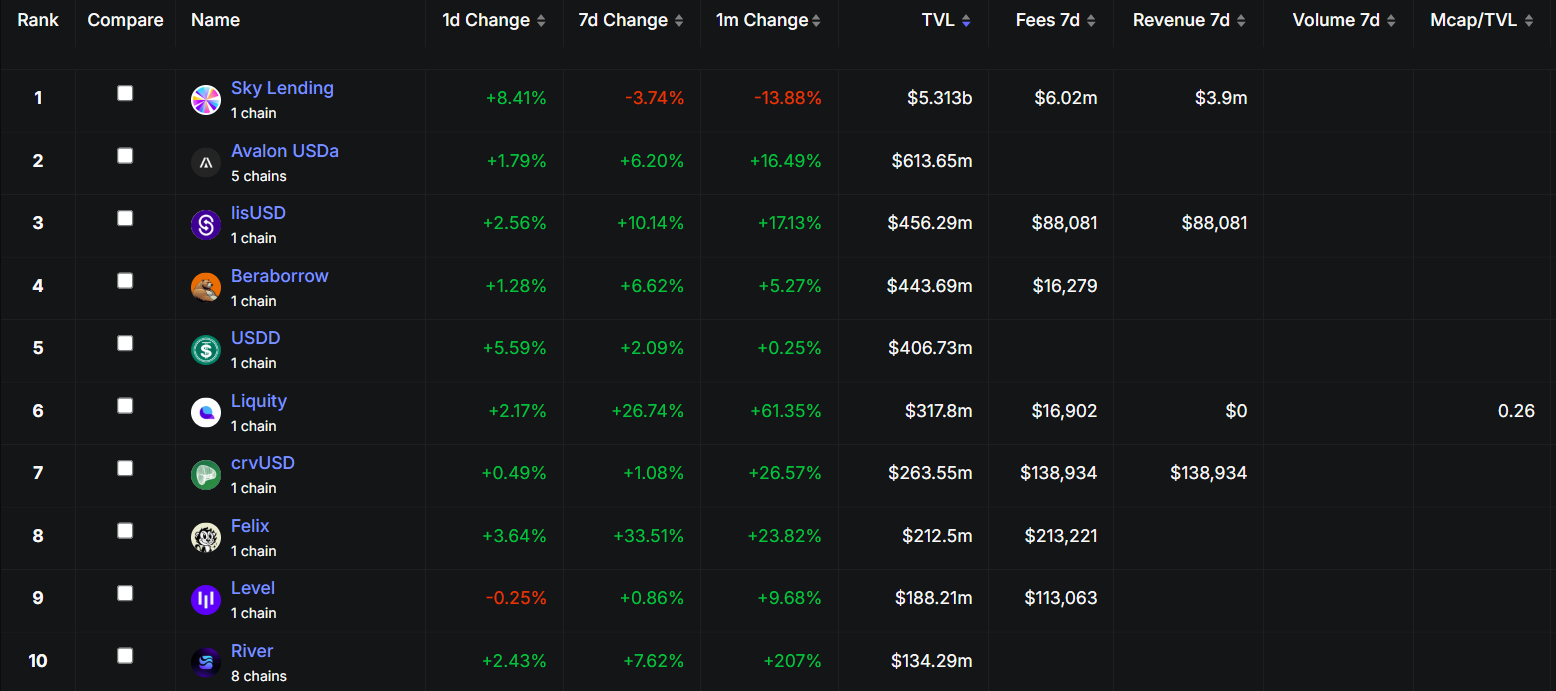

According to DeFiLlama, Avalon’s USDa has around $613 million in total value locked (TVL), ranking as the second-largest Collateralized Debt Position (CDP) stablecoin project, only behind Sky’s USDS.

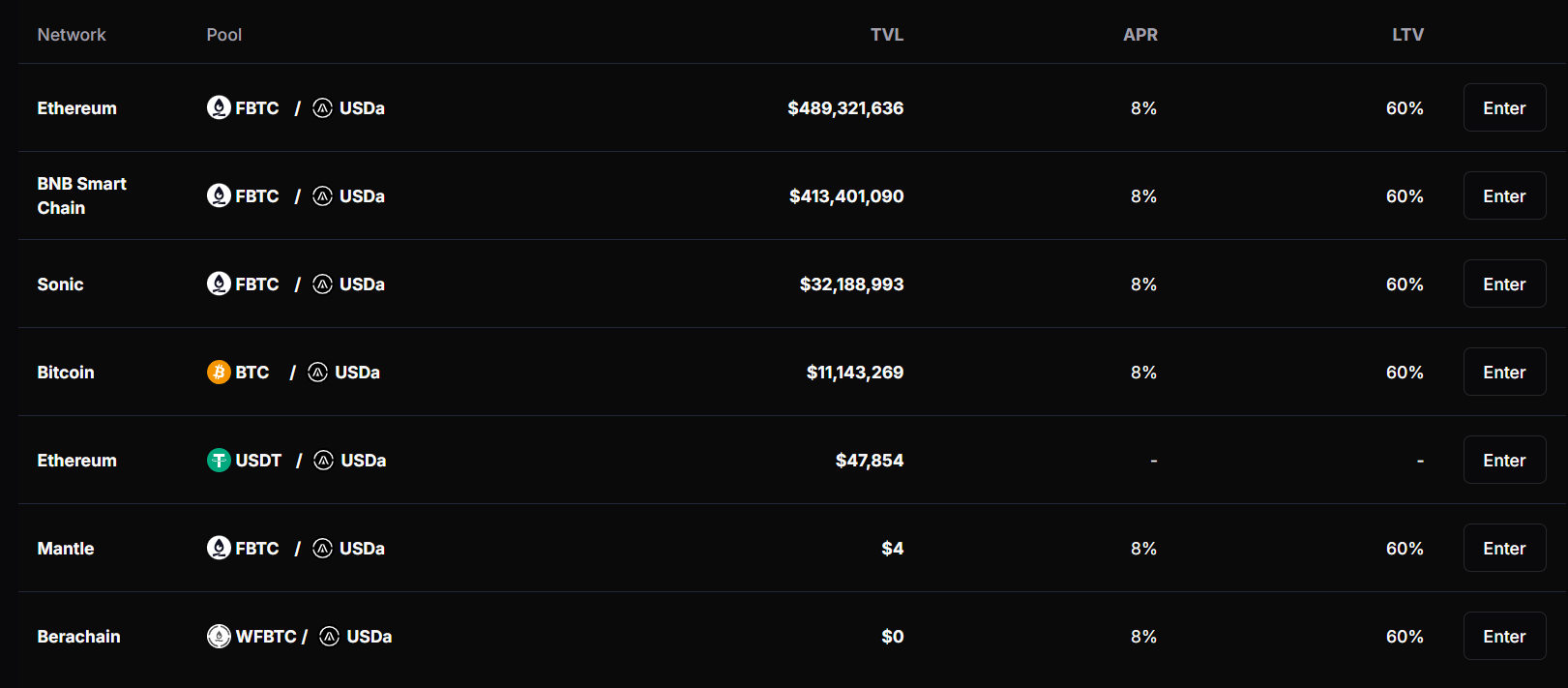

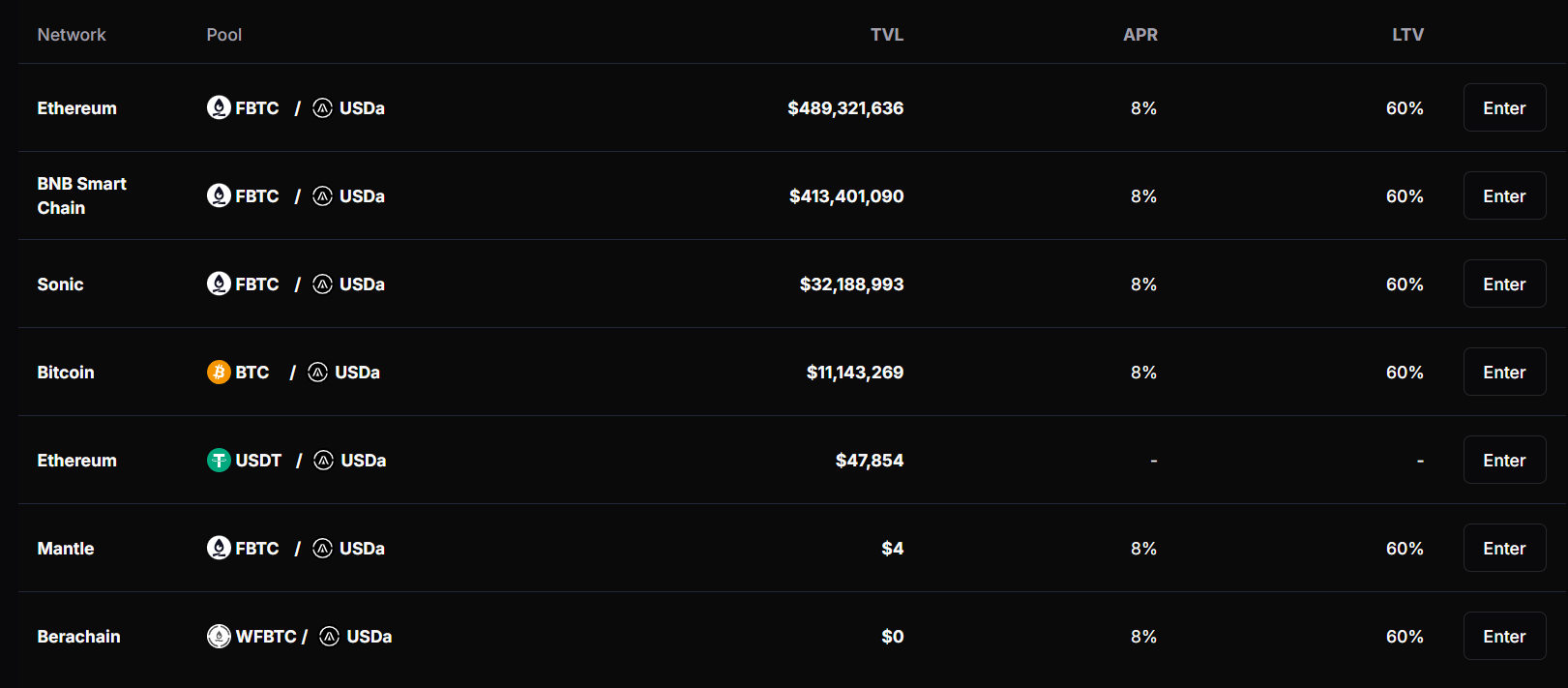

USDa’s TVL has grown quickly since its launch, with pools distributed across multiple blockchains including Ethereum, BNB Smart Chain, Bitcoin, and Mantle, according to data tracked by the project.

The largest TVL portions are on Ethereum and BNB Smart Chain, each holding hundreds of millions in collateral.

Discussing YZi Labs’s decision to back Avalon, Alex Odagiu, the firm’s investment director, stated that the move reflects their conviction in projects that pair technical soundness with long-term vision.

“Avalon exemplifies this by leveraging Bitcoin’s security and liquidity to build a fully integrated financial ecosystem — bridging the gap between Bitcoin’s vast potential and real-world usability, and transforming it into an active economic asset for global markets,” Odagiu said.

Avalon Labs plans to use the new funding to pursue regulatory compliance across multiple jurisdictions and expand its institutional lending business. The company aims to become the first fully regulated on-chain Bitcoin financial institution.

“We’re grateful for YZi Labs’ support as we continue building the premier financial hub for Bitcoin,” said Venus Li, co-founder of Avalon Labs. “Our industry thrives on both user growth and capital inflow, and we constantly challenge ourselves to contribute beyond just capturing existing market share. As pioneers in Bitcoin finance, we aim to introduce fresh capital and new participants.”

YZi Labs’ announcement follows Avalon’s strategic partnership with Bybit to deploy its CeDeFi protocol on the Bybit Earn platform, enabling users to earn yield on Bitcoin through fixed-rate institutional borrowing.

Avalon was previously part of Season 8 of the Most Valuable Builder (MVB) program—an incubation initiative co-led by BNB Chain, YZi Labs, and CoinMarketCap.

The investment came shortly after YZi Labs said it backed Plume Network, a blockchain focused on bringing real-world assets (RWAs) into the crypto ecosystem.

YZi Labs manages over $10 billion in assets globally and has invested in more than 300 projects across 25 countries. Binance’s co-founder Changpeng “CZ” Zhao is the entity’s advisor.

Share this article