The blockchain abstraction layer continues to close the gap between traditional and DLT markets.

This latest feature will bring tokenized US equities and ETFs to the blockchain, making access to these assets easier and available around the clock.

Advancing The Tokenization Market

Chainlink, a bridge between real-world data and blockchain, shared yesterday about a flagship product – Data Streams for the US Equity and ETF market. Several DeFi protocols are already on board, such as GMX, GMX Solana, and Kamino.

Already integrated into leading equities and exchange-traded funds (ETFs), the Data Streams provide real-time pricing for traditional finance (TradFi) assets, including CRCL, QQQ, NVDA, MSFT, and many more, across 37 blockchain networks.

Developers can now access live, contextual data for these markets directly on-chain, enabling tokenized stock trading, perpetual futures, and synthetic ETFs, all backed by institutional dependability. The advancement also brings a roster of novel features, such as market hours enforcement, staleness detection, and high-frequency pricing.

“With Chainlink Data Streams’ fast, reliable, and context-rich market data, production-ready tokenized financial products tied to U.S. equities and ETFs can now be launched directly on-chain.

This represents a significant leap forward for tokenized markets, closing a critical gap between traditional finance and blockchain infrastructure.

We’re excited to be collaborating with Kamino and GMX, two forward-thinking DeFi teams whose work continues to accelerate the convergence of TradFi and DeFi.” – Johann Eid, Chief Business Officer at Chainlink Labs.

To establish a reliable on-chain exchange for these assets would require fast and high-integrity market data. Crypto markets operate 24/7, whereas traditional ones do not, and they can additionally suffer from occasional interference, which poses a challenge for non-stop, decentralized applications (DApps). This can include price gaps, inaccuracies in off-market data, and outages.

How Will it Work

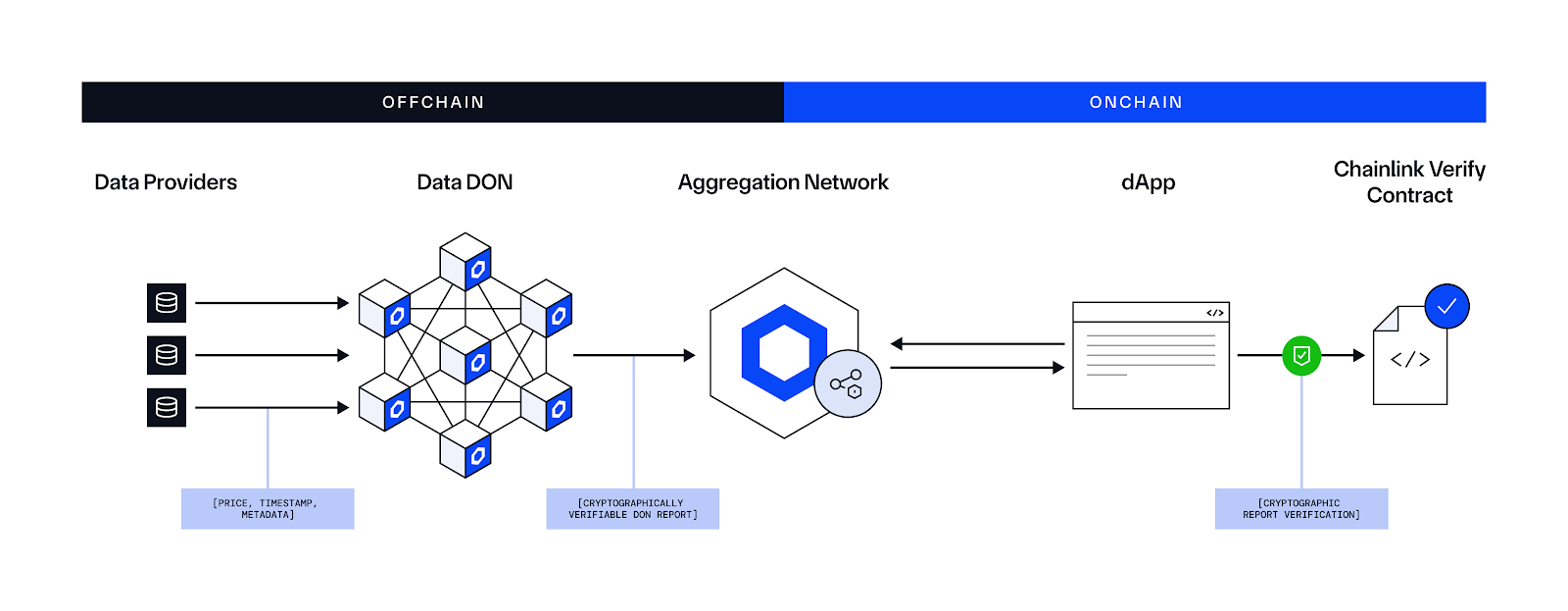

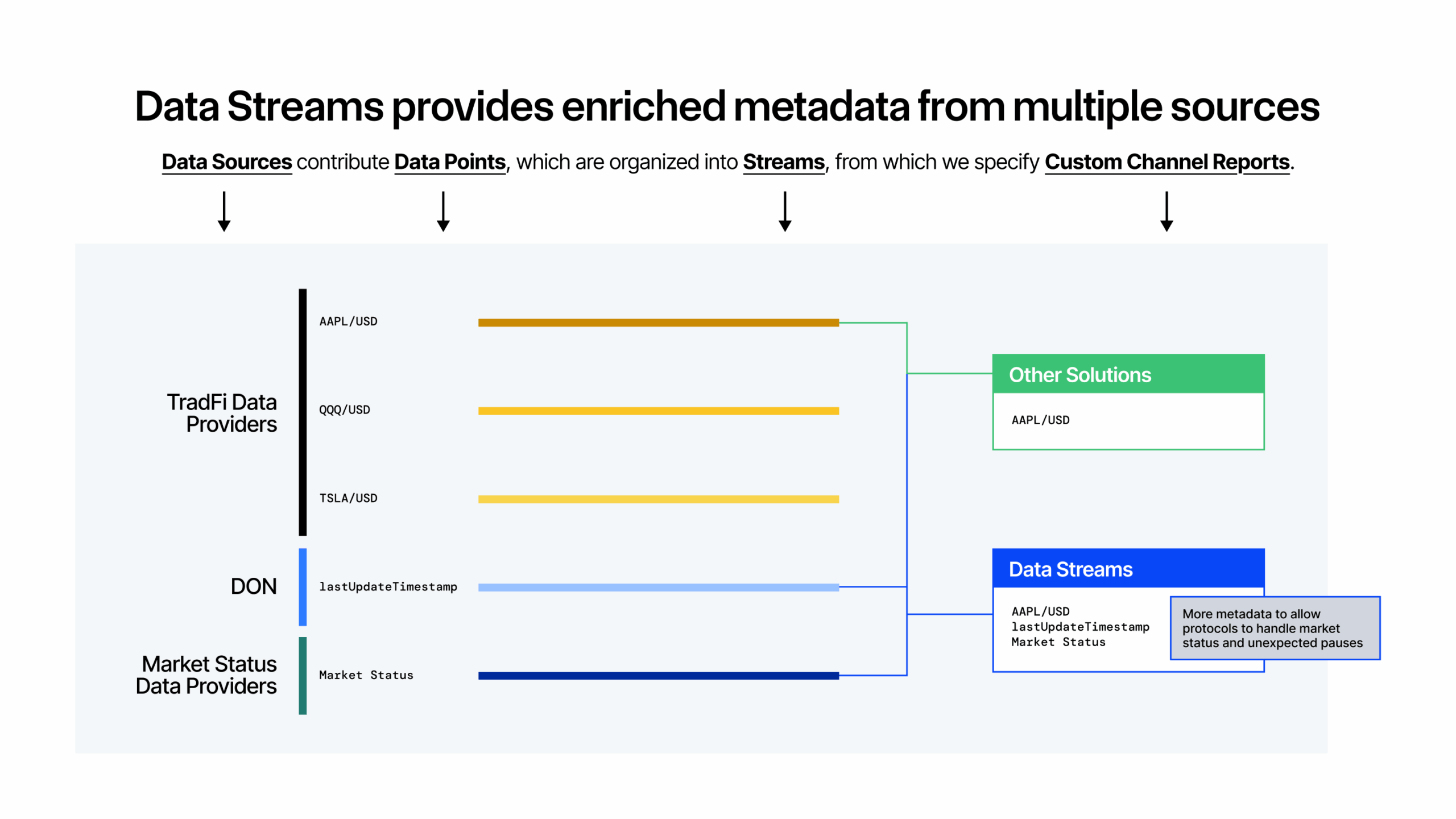

Chainlink Data Streams will aggregate input from multiple primary and backup data sources, thereby enhancing uptime and reliability. This aggregated data will then be processed by decentralized oracle networks (DONs) and transmitted on-chain via a structured schema.

Each data point will be timestamped, allowing protocols to identify the differences between current and historical prices, pause automatically during market off-hours, and implement real-time risk management.

This data schema is designed for advanced DeFi composability, as it provides structured pricing that aids in accurate liquidations, trade halts, strategy adjustments, and collateral valuation. It will also be able to distinguish between real-world prices taken from traditional, open markets and prices of tokenized stocks available 24/7. This can open the door for arbitrage opportunities and risk management strategies.

Some use cases for the products enabled by the Data Streams are perpetuals, lending/borrowing, vault protocols, brokerage platforms, and more.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!